This Blog has been removed from our site

JANUARY 15, 2026

Momentum Meets Opportunity: In2Assets Sets the Stage for a Record-Breaking 2026

Read More

NOVEMBER 21, 2025

Positive Momentum Surges in KwaZulu-Natal’s Commercial Property Sector as In2Assets Closes Over R2...

Read More

NOVEMBER 19, 2025

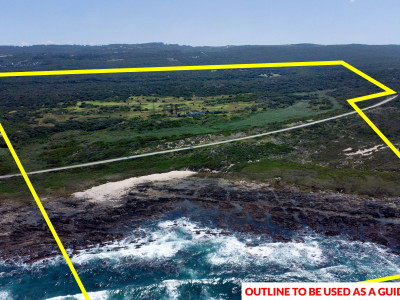

Unprecedented Coastal Canvas: In2assets Unveils Rare Eastern Cape Development Site with Private Ocea...

Read More

OCTOBER 14, 2025

Realizing Maximum Value for Durban Harbour Property: Why Auctions Lead the Market

Read More

OCTOBER 09, 2025

Partnership Proven: In2assets Reinforces Long-Standing Broker Collaboration, Driving Superior Commer...

Read More

AUGUST 06, 2025

When Times Get Tough: Why Company Owners Need to Free Up Cash Flow and How Property Auctions Provide...

Read More

JULY 11, 2025

The Unseen Foundation: Why Valuation is Key to Auction Success and the Secrecy of the Reserve Price

Read More

JULY 03, 2025

Unveiling the Magic of Commercial Property Auctions

Read More

JUNE 20, 2025

The True Value of Auctions: Evaluating Worth Through Bidding Dynamics

Read More